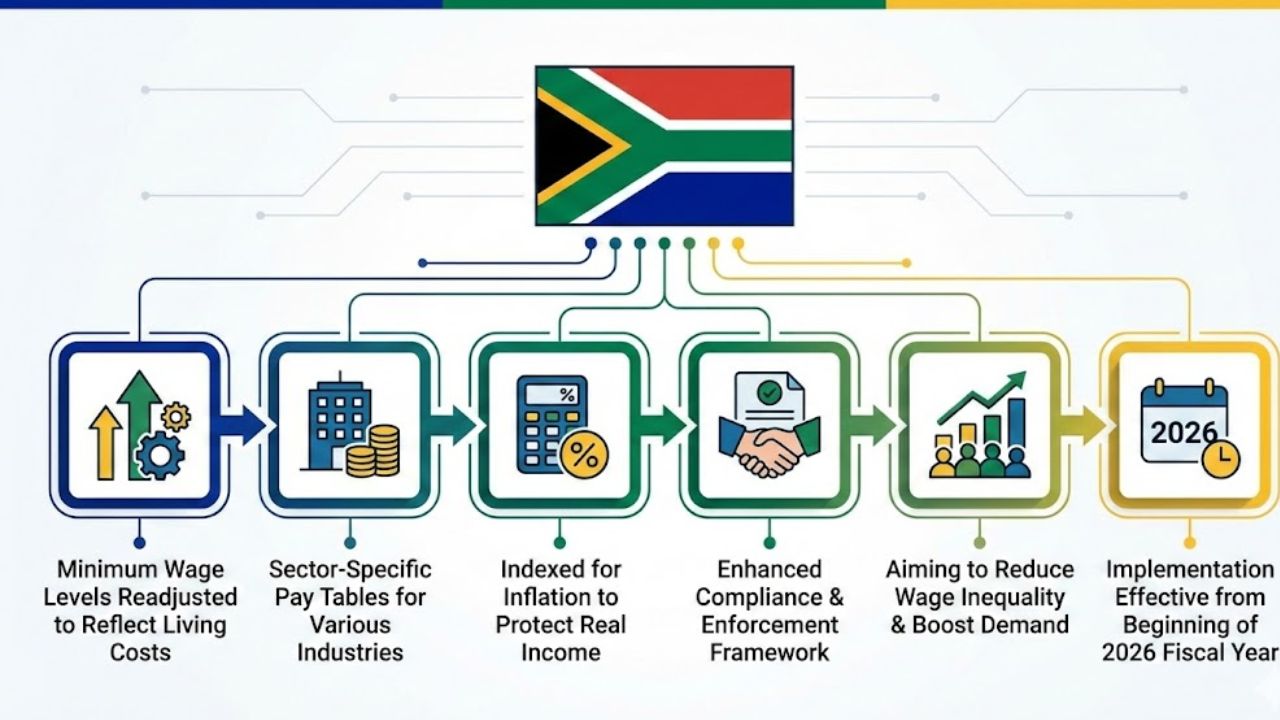

South Africa has introduced a significant update to its wage framework by officially withdrawing the 2026 wage rates and implementing newly finalised 2026 pay tables. This change impacts employers, employees, and wage negotiators across multiple industries, as the revised rates align with current economic conditions, inflation movements, and labour market priorities. The release of the 2026 tables sets the foundation for salary revisions, minimum wage adjustments, and wider employment policy updates.

Why the 2026 Wage Rates Were Withdrawn

The 2026 wage rates were originally developed using earlier economic projections. However, ongoing shifts such as changing inflation patterns, commodity price fluctuations, and evolving labour demand made those benchmarks outdated. Authorities determined that an updated framework was necessary to ensure wages more accurately reflect current living costs and economic realities. As a result, the 2026 tables were formally phased out and replaced with revised 2026 figures.

What the 2026 Pay Tables Cover

The newly issued 2026 pay tables span a wide range of wage categories, including minimum wage levels across sectors, statutory pay guidelines for specific job grades, and prescribed benchmarks for fair compensation throughout industries. These tables are designed to assist employers in setting appropriate wages while helping employees understand expected pay standards based on role and qualifications. Where applicable, the updated rates also account for regional variations.

Changes to Minimum Wage Levels

Among the most closely monitored aspects of the 2026 pay tables is the revised minimum wage rate. Workers earning at or near the minimum threshold will see adjustments intended to protect purchasing power amid inflation and rising living expenses. The new minimum wage acts as a baseline for employers and is expected to influence wage negotiations beyond minimum-level roles.

How Employers and Employees Are Affected

Employers are required to review existing compensation structures and ensure alignment with the 2026 wage scales. This may involve increasing pay for workers whose earnings fall below the updated benchmarks. Employees, meanwhile, are encouraged to familiarise themselves with the new tables to understand where their current wages stand and whether adjustments are required under the revised guidelines.

Moving From 2026 Rates to the 2026 Framework

The transition from the 2026 wage rates to the 2026 pay tables is designed to be seamless, supported by clear guidance for organisations and labour unions. Employers must update payroll systems to reflect the new rates during the 2026 financial year. Labour authorities are also expected to provide clarifications and compliance support to assist businesses throughout the transition.

Why the Update Matters for the Labour Market

Regular updates to wage rates and pay tables play a vital role in maintaining a balanced and sustainable labour market. The move to the 2026 framework aims to enhance income fairness, consumer confidence, and wage alignment with economic conditions. By addressing outdated benchmarks, the updated tables help reduce wage stagnation while offering clearer guidance for employers.

Steps Workers Should Take Now

Employees should review the 2026 wage tables promptly and compare them with their current earnings. Where differences arise, workers may raise concerns with employers or union representatives to seek adjustments that comply with the updated framework. Staying informed enables workers to protect their right to fair compensation.

What Employers Should Get Ready For

Employers should prepare by updating compensation policies, auditing payroll systems, and ensuring full compliance with the new wage guidelines. Human resources and payroll teams must take care to avoid errors that could lead to underpayment or regulatory issues. Clear and timely communication with employees about changes and implementation timelines will help ensure a smooth transition.