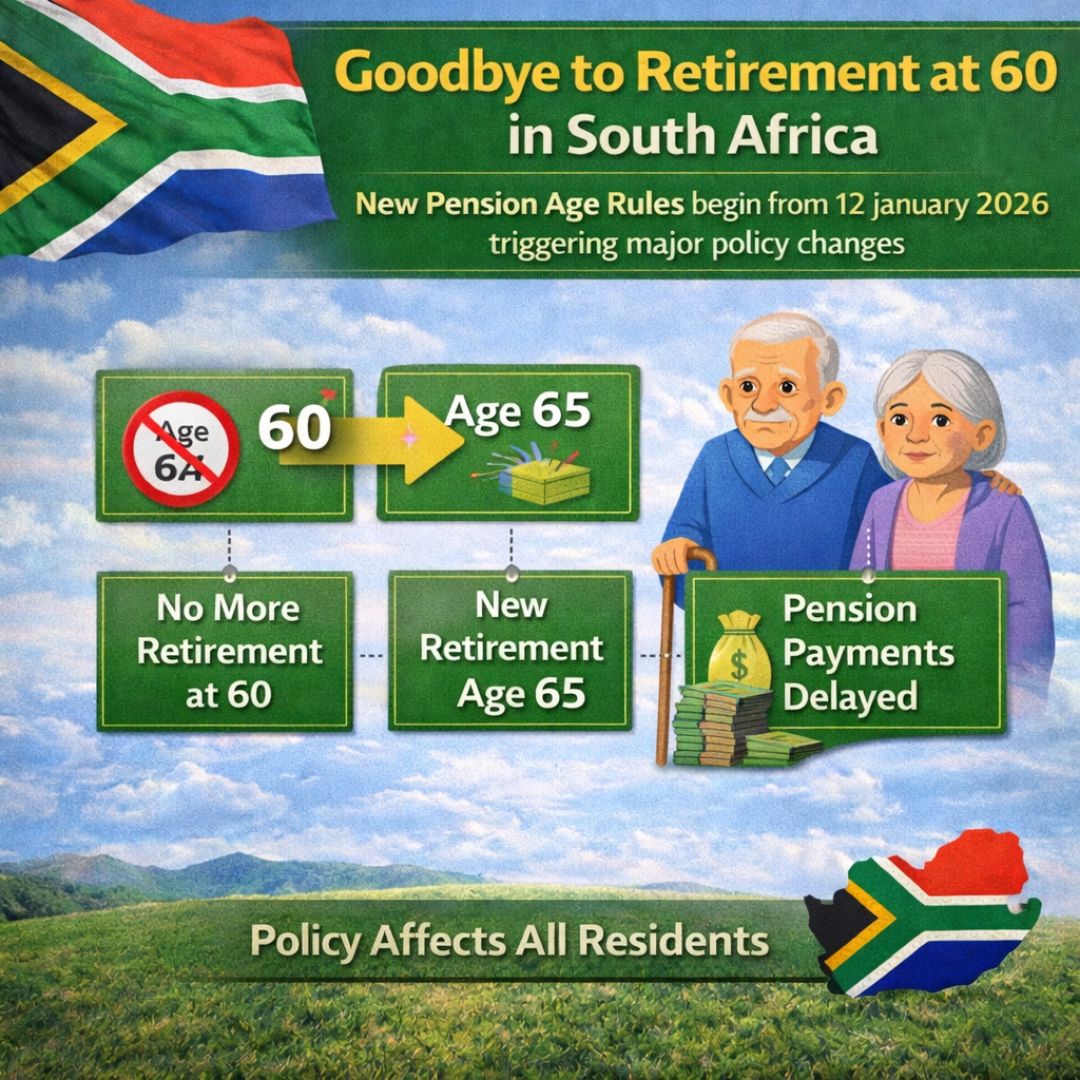

South Africa is getting ready for a big change in retirement rules that will start on 12 January 2026. For many years most workers retired at age 60. However things are different now because people are living longer and the economy has changed. This has made the government reconsider the old retirement age. The new retirement system will work differently for government workers & private sector employees. These changes will affect pensions and savings plans and how people prepare financially for their future across the country.

South Africa Raises Retirement Age Under New Pension Rules

South Africa has introduced new pension age rules that move away from the standard retirement age of 60. The updated system means workers may need to stay employed longer based on their job sector and pension fund requirements. This change responds to increased life expectancy and the need to manage rising pension costs while keeping the economy stable & maintaining workforce levels. Government representatives say that working longer helps keep pension systems financially sound and gives people more time to save for retirement. Many workers are worried about this change though. Those in jobs that require physical labor are particularly concerned about their health & whether they can find work as they get older. There are also questions about financial security during those extra working years.

How the New Pension Age Affects South African Workers

South African workers now face practical changes to their retirement plans that extend beyond just a new age requirement. When someone can retire depends more heavily on their employment contract retirement fund policies and agreements with their employer. Workers must now consider rules specific to their industry, the terms set by their pension fund, penalties for retiring early and longer periods of contributing to their pension. Some employees appreciate the chance to work longer and build up larger retirement benefits. Others are concerned about having to wait longer before they can access their pension funds. Financial advisors recommend that workers examine their retirement plans well in advance to prevent unexpected shortfalls in their income during retirement.

New Retirement Age Rules and Pension Planning in South Africa

The introduction of a higher retirement age places new emphasis on proactive pension planning in South Africa. Individuals approaching their late 50s are urged to reassess savings strategies and projected retirement timelines. Important planning factors now include adjusted retirement timelines, revised savings targets, healthcare cost planning, and income bridge options. Employers and pension funds are also expected to provide clearer guidance to members. While the reform aims to strengthen long-term pension sustainability, its success will largely depend on how well workers adapt and receive support during the transition.

Summary and Practical Implications

The removal of guaranteed retirement at age 60 marks an important shift in South African culture and finances. The updated regulations aim to match pensions with current economic conditions while requiring people to take more control of their own retirement planning. Main points to understand are that retirement will likely happen later in life, individuals must plan more carefully government policies are driving these changes, and building strong long-term finances is now critical. Workers need to stay updated on these developments & talk to financial experts to handle the changing pension system with confidence.

| Category | Before 2026 | From 7 January 2026 |

|---|---|---|

| Standard Retirement Age | 60 years | Above 60 (varies by sector) |

| Pension Access | At retirement | Linked to updated age rules |

| Contribution Period | Shorter | Extended |

| Early Retirement | Common | More restrictions |

| Planning Complexity | Moderate | Higher |