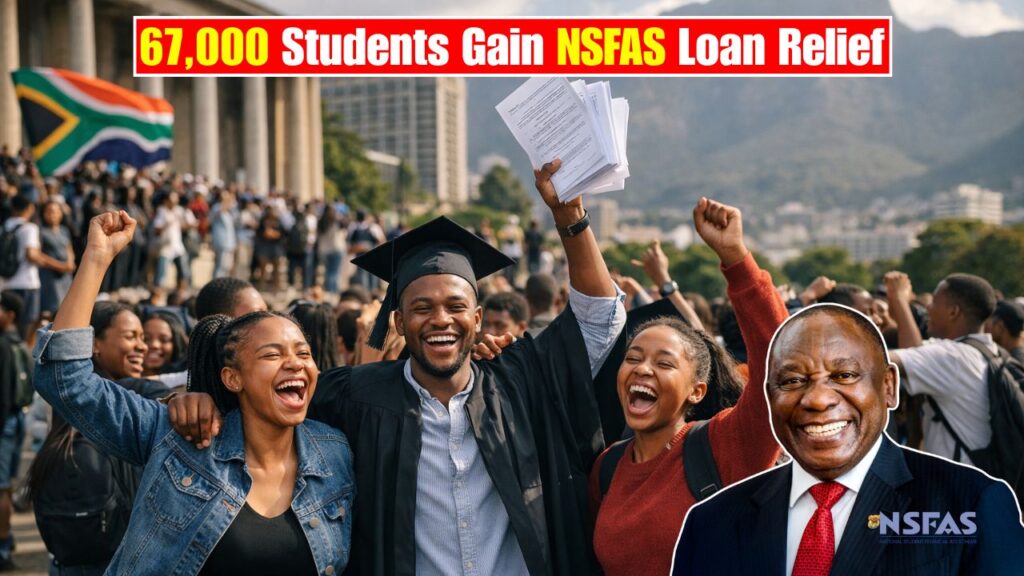

South Africa’s higher education funding landscape is shifting as long-awaited relief finally reaches thousands of former students. From mid-January 2026, the National Student Financial Aid Scheme (NSFAS) begins rolling out a structured loan forgiveness programme aimed at easing long-standing debt pressures. The initiative targets qualifying beneficiaries who previously relied on student loans to complete their studies and have since faced repayment challenges. With education costs rising and graduate employment still uneven, this move is designed to restore financial stability, encourage compliance, and rebuild trust between students and the national funding system.

NSFAS Loan Forgiveness Rollout Begins Nationwide

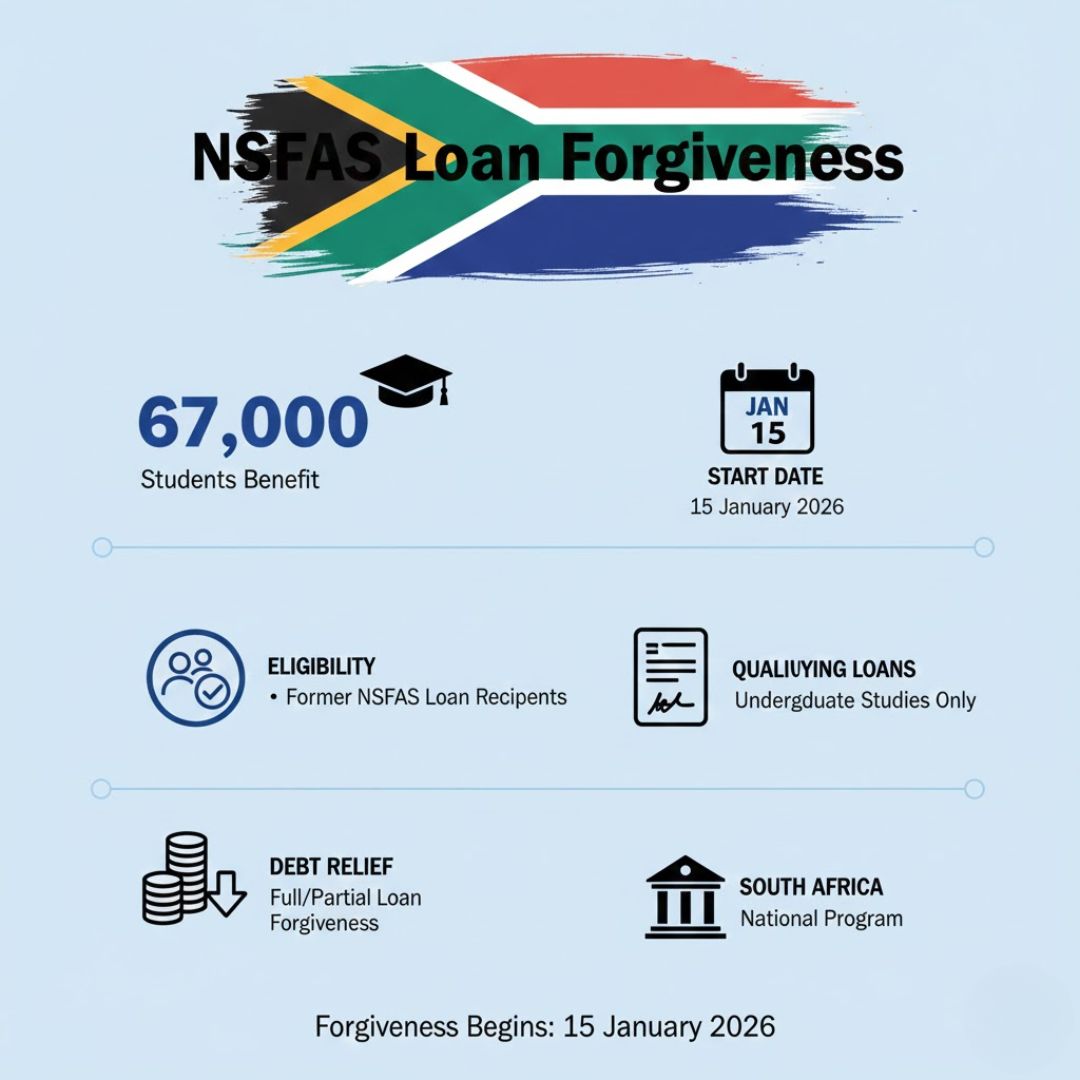

The NSFAS loan forgiveness process officially starts on 15 January 2026, covering an estimated 67,000 former students across South Africa. The scheme focuses on clearing historical debt for individuals who meet updated academic and income-related criteria. Many beneficiaries struggled for years with balances that limited their credit access and employment prospects. By introducing automatic debt clearance, verified beneficiary lists, digital account updates, and institutional data matching, NSFAS aims to ensure accuracy and fairness. Officials note that this rollout is phased, meaning not all accounts will reflect changes on the same day, but eligible recipients should see progress within weeks.

Who Qualifies Under NSFAS Loan Forgiveness Rules

Eligibility for the loan forgiveness programme depends on several clearly defined conditions. Applicants must have received NSFAS loans before the full bursary model was introduced and must have completed their qualifications or met specific exit criteria. Income thresholds also play a key role, ensuring relief reaches those who genuinely need it. The process relies on household income checks, completion status verification, historical loan records, and means test compliance. Students who dropped out due to financial hardship are not automatically excluded, but their cases may require additional review before approval.

How NSFAS Loan Forgiveness Impacts Students

For many former students, loan forgiveness offers more than just financial relief—it opens doors to long-delayed opportunities. Cleared debt can improve credit profiles, reduce stress, and allow graduates to focus on career growth or further studies. NSFAS believes the policy will also improve future repayment culture by resetting strained relationships. Key outcomes include credit record recovery, reduced repayment pressure, graduate mobility boost, and long-term affordability. While the programme does not refund past payments, it provides a clean slate that many have waited years to see.

What This Means for Higher Education Funding

The introduction of loan forgiveness marks a strategic shift in how South Africa manages student debt. It reflects lessons learned from earlier funding models and acknowledges the economic realities facing graduates. By pairing relief with stricter future funding rules, NSFAS hopes to build a more sustainable system. This approach balances compassion with accountability, using policy reset signals, system credibility repair, future funding safeguards, and student trust rebuilding to guide reforms. Analysts suggest this could influence how other public funding schemes address legacy debt.

| Category | Details |

|---|---|

| Programme Start Date | 15 January 2026 |

| Total Beneficiaries | Approximately 67,000 students |

| Eligible Loan Type | Pre-bursary NSFAS loans |

| Income Assessment | Means-tested household income |

| Account Update Method | Automatic system reconciliation |

Frequently Asked Questions (FAQs)

1. When does NSFAS loan forgiveness start?

The loan forgiveness process begins on 15 January 2026.

2. Do students need to apply for forgiveness?

No, eligible accounts are reviewed and updated automatically by NSFAS.

3. Does forgiveness apply to all NSFAS funding?

It applies only to qualifying historical loans, not current bursaries.

4. Will past repayments be refunded?

No, the programme clears remaining debt but does not refund previous payments.