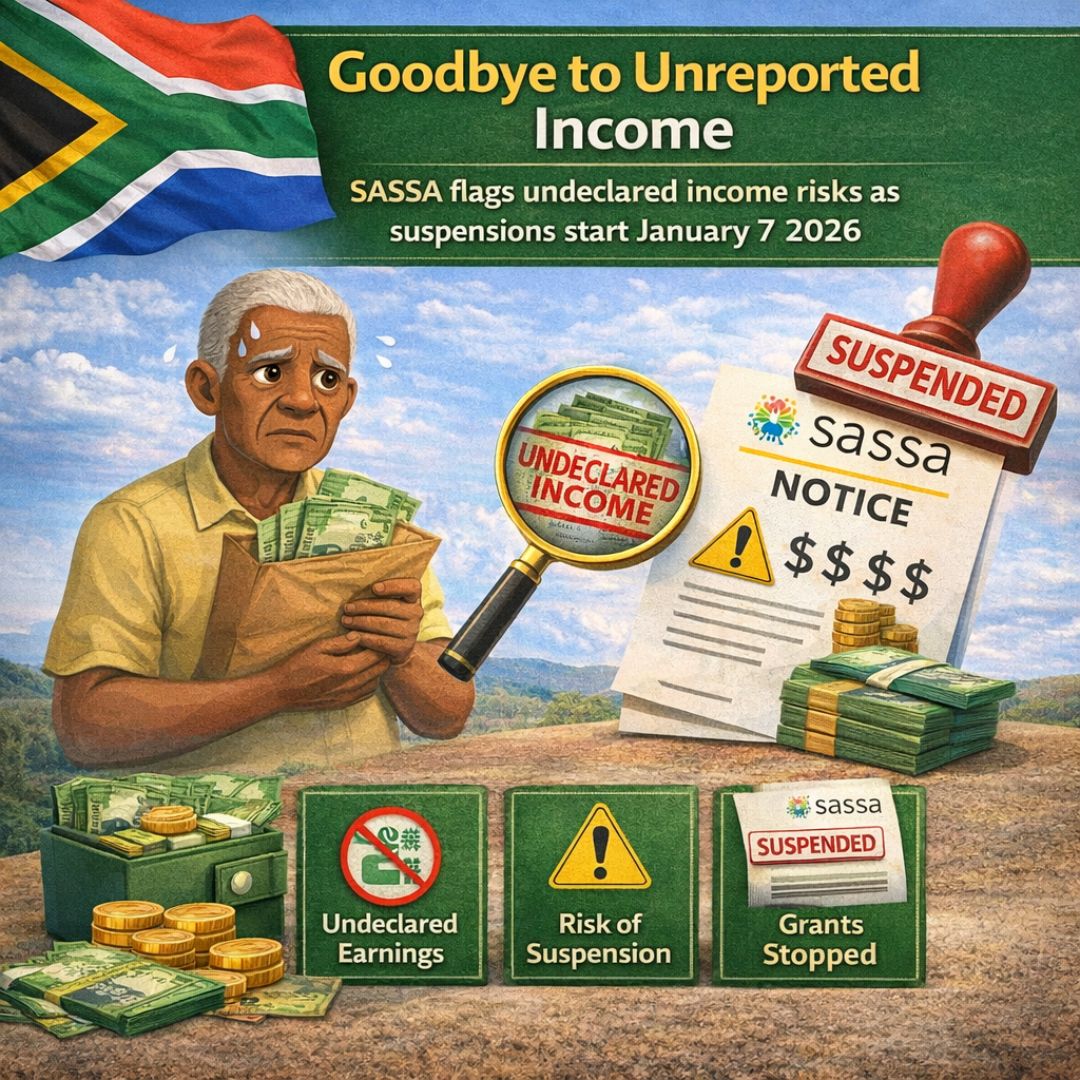

Starting in January 2026 South Africa’s social grant system will enforce stricter compliance rules. The South African Social Security Agency (SASSA) has issued warnings to beneficiaries about the importance of reporting all income. This change aims to protect limited public resources & ensure grants go to people who genuinely qualify for assistance. Many people receiving grants do not realize that even small amounts of additional income can impact their eligibility. SASSA has implemented new data-matching systems that make it easier to detect unreported earnings. The agency has emphasized that being transparent about income is now mandatory rather than optional. Beneficiaries who fail to declare their income face serious consequences. SASSA can immediately suspend payments to anyone found withholding income information. This enforcement approach reflects the government’s commitment to preventing fraud and misuse of social assistance funds. The new systems allow SASSA to cross-reference beneficiary information with other government databases and financial records. This technology makes it much harder for people to hide additional sources of income while receiving grants. Recipients must understand that all forms of earnings need to be reported regardless of how small they might seem.

SASSA Tightens Checks on Undeclared Income Nationwide

Starting 7 January 2026, SASSA will implement enhanced verification measures aimed at uncovering hidden income among all major grant recipients. The agency will use bank statements, employment records, and third-party reports to identify any undisclosed earnings that could push beneficiaries above the allowed income limits. This scrutiny applies not only to full-time employment but also to casual work and irregular payments. Officials emphasise that the purpose is fairness, not punishment, though the automated system reviews mean there will be fewer opportunities for manual appeals before action is taken. Beneficiaries are encouraged to update their details early to prevent unexpected interruptions. The key message is clear: accurate reporting protects both your grant and the integrity of the system.

Grant Suspensions Linked to Undeclared Earnings

Grant pauses will occur only when clear income threshold violations are detected. If SASSA flags a discrepancy, payments may be temporarily suspended while the issue is reviewed. During this period, recipients might experience short-term payment holds until the necessary proof is submitted. In serious cases, long-term suspensions or cancellations could happen. SASSA highlights that these measures are designed to correct records, not to permanently block qualified beneficiaries. However, failure to respond promptly to verification requests can complicate reinstatement. Understanding these rules helps recipients act quickly and avoid unnecessary financial stress.

How Income Updates Affect Grant Eligibility

Under the updated SASSA system, keeping your information current is essential. Beneficiaries must report new jobs, side income, or support from family members. These updates impact monthly eligibility reviews and ensure accurate grant assessments. Even minor changes can affect outcomes, making precise income disclosure more important than ever. SASSA has expanded both online and in-person options to simplify updates, reducing the risk of system-flagged discrepancies. By staying proactive, recipients can maintain uninterrupted grant access and avoid the stress of last-minute compliance checks.

Summary and Practical Takeaways for Beneficiaries

The January 2026 measures represent a shift toward stricter oversight in South Africa’s social support system. While the changes may feel intimidating, they also bring greater clarity and consistency. The focus on transparent reporting is designed to protect vulnerable households and reduce misuse. Beneficiaries who understand the rules and act early are unlikely to face problems. Ignoring requests or assuming issues will go unnoticed is risky in a system that uses advanced data matching. Ultimately, these changes encourage responsible grant management and reinforce the principle that social support functions best when everyone follows the same rules.

| Grant Type | Income Reporting Requirement | Consequence if Not Declared |

|---|---|---|

| Older Persons Grant | All sources of personal and household income | Payment may be suspended until compliance |

| Disability Grant | Employment earnings and support received | Eligibility may be reviewed or revoked |

| Child Support Grant | Total household income must be reported | Payments temporarily withheld until updated |

| SRD R370 Grant | Bank-linked income must be declared | Grant may be cancelled if undisclosed |